The Facts About Fortitude Financial Group Revealed

The Facts About Fortitude Financial Group Revealed

Blog Article

The Main Principles Of Fortitude Financial Group

Table of ContentsThe 15-Second Trick For Fortitude Financial GroupThe smart Trick of Fortitude Financial Group That Nobody is DiscussingFortitude Financial Group - The FactsSome Of Fortitude Financial GroupFascination About Fortitude Financial Group

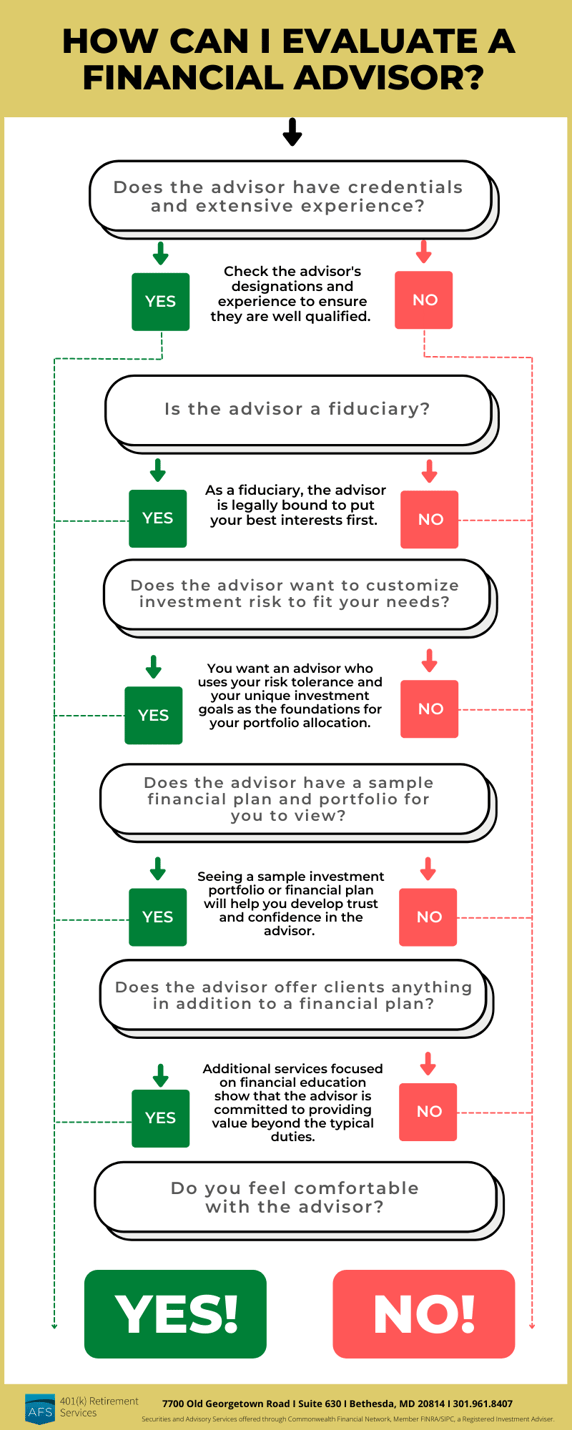

Note that several advisors will not manage your assets unless you meet their minimal demands. When picking an economic consultant, discover out if the individual complies with the fiduciary or suitability requirement.If you're seeking economic guidance however can not pay for a financial expert, you may take into consideration utilizing an electronic financial investment consultant called a robo-advisor. The wide field of robos extends systems with accessibility to financial advisors and financial investment management. Encourage and Improvement are 2 such instances. If you fit with an all-digital system, Wealthfront is another robo-advisor option.

You can locate a financial expert to help with any kind of aspect of your monetary life. Financial advisors may run their very own firm or they could be part of a bigger workplace or bank. No matter, an advisor can assist you with every little thing from building a financial strategy to spending your cash.

Some Ideas on Fortitude Financial Group You Need To Know

See to it you ask the appropriate questions of anybody you consider employing as a financial expert. Check that their qualifications and abilities match the services you want out of your consultant - https://ameblo.jp/fortitudefg/entry-12865115246.html. Do you intend to find out more about financial experts? Have a look at these short articles: SmartAsset complies with an extensive and detailed Editorial Plan, that covers principles bordering accuracy, trustworthiness, content self-reliance, competence and objectivity.

Most individuals have some emotional connection to their cash or the points they purchase with it. This emotional connection can be a key reason we might make poor monetary decisions. A specialist financial consultant takes the feeling out of the equation by providing unbiased guidance based upon knowledge and training.

As you experience life, there are economic decisions you will make that could be made more conveniently with the assistance of an expert. Whether you are attempting to lower your financial obligation lots or intend to start preparing for some lasting objectives, you could gain from the services of a monetary consultant.

The Basic Principles Of Fortitude Financial Group

The essentials of financial investment administration include purchasing and selling financial assets and other financial investments, yet it is moreover. Handling your financial investments entails understanding your short- and lasting objectives and utilizing that info to make thoughtful investing decisions. A financial advisor can provide the information needed to assist you diversify your financial investment profile to match your preferred level of threat and fulfill your monetary goals.

Budgeting offers you a guide to how much cash you can invest and just how much you should conserve monthly. Adhering to a spending plan will aid you reach your brief- and long-term economic goals. A financial expert can assist you describe the activity steps to take to establish and preserve a spending plan that works for you.

Sometimes a clinical bill or home fixing can all of a sudden add to your financial obligation load. An expert debt monitoring plan helps you repay that financial obligation in the most economically helpful way feasible. A financial consultant can aid you assess your financial obligation, focus on a financial debt payment technique, offer options for debt restructuring, and detail a holistic strategy to far better manage debt and meet your future economic goals.

Not known Details About Fortitude Financial Group

Personal capital evaluation can tell you when you can manage to purchase a new cars and truck or just how much cash you can include to your cost savings monthly without running short for needed expenses (Financial Services in St. Petersburg, FL). A monetary expert can help you plainly see where you invest your cash and after that apply that understanding to help you understand your economic health and exactly how to improve it

Risk administration solutions identify possible dangers to your home, your lorry, and your household, and they help you put the right insurance plan in position to alleviate those threats. A monetary consultant can aid you create a technique to shield your earning power and reduce losses when unexpected things occur.

The Definitive Guide to Fortitude Financial Group

Lowering your tax obligations leaves even more money to add to your financial investments. Investment Planners in St. Petersburg, Florida. A financial consultant can assist you use philanthropic offering and investment strategies to minimize the amount you have to pay in tax obligations, and they can show you how to withdraw your cash in retired life in a manner that likewise decreases your tax obligation concern

Also if you didn't start early, university preparation can assist you put your youngster through college without facing unexpectedly big expenses. A monetary advisor can guide you in recognizing the very best means to conserve for future university expenses and just how to fund prospective gaps, clarify just how to decrease out-of-pocket university prices, and recommend you on eligibility for economic aid and gives.

Report this page